From CSRD Directive to ESG Reporting

Nowadays, sustainability is no longer something you can ignore; it has become essential. Companies worldwide now understand that environmental awareness, social responsibility, and good governance are crucial for their long-term success. Therefore, they are now required to report on these matters, ensuring transparency about their efforts and performance in sustainability. But how do you get started with this?

ESG simply explained in 8 concrete steps.

Step 1: Understand the essence of ESG reporting (basic ESG explanation

Preparing a sustainability report requires thorough preparation and extensive research. This involves not only understanding environmental issues such as CO2 emissions, but also exploring the social and societal aspects of sustainability. A deep understanding of social pillars, such as wellbeing, diversity, and inclusion, is essential for linking sustainable business practices with ESG reporting. It’s also important to stay informed about recent EU guidelines and legislation. Having a solid foundation(more info in our trend report) in these aspects simplifies the reporting process and enables organizations to effectively invest in and report on their sustainability initiatives.

Step 2: Dive into the various Frameworks of ESG

Get acquainted with various reporting frameworks, with special attention to the EU’s CSRD-directive. This directive determines whether your organization is required to prepare a sustainability report, which will apply to large, publicly traded companies starting July 1, 2024, and will later be expanded to others. This requirement is becoming increasingly relevant as investors, customers, and employees place greater importance on sustainability. It is also essential to become familiar with the ESRS standards for ESG reporting, as they assist in identifying the aspects to be reported for each ESG pillar.

Furthermore, it is highly recommended to foster awareness and enthusiasm for sustainability initiatives within the organization through internal workshops involving both employees and management. This helps to increase their knowledge and boost their motivation.

Step 3: Establish an internal CSR team

Creating a high-quality sustainability report requires specific skills and knowledge. A designated individual coordinates the process, serves as the central point of contact, and leads the efforts for collecting, analyzing, and reporting sustainability information. The Corporate Social Responsibility (CSR) team should not only possess the necessary expertise, but also understand and integrate the broader business perspective into the sustainability strategy.

Involve other relevant departments for a comprehensive approach, as sustainability impacts various aspects of the organization, such as financial reporting, external communication, and human resources. An all-encompassing approach ensures an effective implementation of sustainability initiatives.

We are here to support. When drafting your first sustainability report, it is advisable to engage experts, especially for the complex social aspects of ESG. This expertise not only saves you time, but is also invaluable for identifying relevant social issues and implementing effective strategies.

Step 4: Identification of stakeholders and material ESG factors

For an accurate report, one must identify relevant ESG factors through a double materiality analysis, as prescribed by the ESRS and mandated by the CSRD. This approach requires a thorough assessment of both internal and external ESG factors.

Identifying stakeholders who are affected by or have an influence on sustainability performance is crucial. This includes both internal parties such as employees and external groups such as customers, suppliers, investors,

Stakeholders:

For writing the report, it is of utmost importance to identify and engage the key stakeholders, and gather their perspectives on the main ESG trends within the company. These stakeholders, ranging from individuals to organizations, can have a significant impact on or be influenced by the company.

- Internal stakeholders:

All departments within the company, including management, play a significant role in formulating the framework for the ESG report. Their contributions are indispensable for understanding the mission, values, policies, strategies, objectives, and ambitions of the company.

- External stakeholders:

External stakeholders such as investors, suppliers, customers, industry organizations, and local communities provide valuable insights that are crucial for understanding external influences on the company and shaping the future ESG strategy. Effectively engaging these key stakeholders, through methods such as personal meetings, workshops, or online surveys, is crucial for the success of the company’s sustainability strategy.

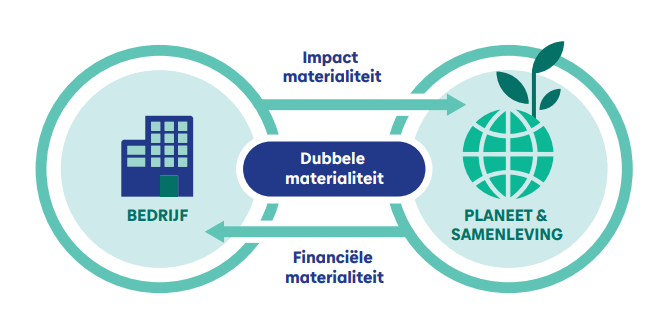

Double materiality

Double materiality is a concept within the framework of sustainability reporting, which emphasizes that organizations need to consider two types of materiality when reporting on their activities:

- Financial materiality:This aspect concerns the impact of environmental and social issues on the financial performance and value of a company. It revolves around identifying sustainability issues that can have a significant impact on the financial health and profitability, such as climate change, working conditions, and corruption.

- Environmental and social materiality: This aspect focuses on the impact of corporate activities on society and the environment, including effects on the environment, local communities, and the broader society. It involves evaluating issues such as emissions, waste management, and working conditions.

The concept of double materiality is particularly relevant because it helps companies identify and assess risks and opportunities from both financial and social and environmental perspectives. This provides stakeholders with a more comprehensive view of the sustainability performance and strategies of a company.

Step 5: Data collection and measurement

Once you have identified the key ESG factors, begin collecting data on these factors. Implement new processes and collect the necessary sustainability data throughout the entire financial year. These data can come from internal sources such as your ERP system, financial reports, employee surveys, or customer reviews, as well as from external sources such as industry benchmarks and ESG assessments.

When collecting internal data about your employees, it’s important to carefully consider the best approach to make the data accurate and reliable. An option is to use People Sustainability Scan, integrated via workshops, to uncover and map hidden issues within your company.

To save time and effort, the use of specialized software is highly recommended. Take, for example, “own workforce,” a crucial aspect of the social ESG factors that many companies must report on according to the CSRD regulations. Integration of tools like eSgility into your data collection processes will greatly assist you in mapping your sustainability efforts. This results in clear dashboards with outcomes and analyses that you can easily utilize in your final report.

Step 6: Present the data clearly

Now that you have the data, it’s time to structure it. There are various reporting standards available, such as ESRS, ISSB, and GRI. If you are required to report on ESG factors within the CSRD, it is advisable to follow the ESRS, as it is likely to be the most widely used standard. Make sure to consult the ESRS to translate material sustainability themes into measurable goals and indicators.

Organize the data clearly and concisely. For each ESG factor, explain why you are reporting on it (mandatory or self-determined) and demonstrate what you have done in the previous year. Repeat this process for all key factors.

You don’t have to start compiling the report from scratch. Many companies already have experience with publishing ESG reports. Use these existing reports as a source of inspiration, which significantly simplifies the process for you. Take the time to thoroughly review these reports.

Step 7: Verification of the reporting

Before publishing your report, it should be carefully reviewed by an internal or external auditor to ensure reliability. After satisfaction with the content, official approval follows. This starts with internal approval, involving key executives such as the CEO, CFO, or Chief Sustainability Officer to gain their support and signature, confirming their involvement in the reporting. If your organization has reporting obligations, the report must be audited by an external accountant registered with the Financial Services and Markets Authority (FSMA) and issue an Assurance statement to confirm the reliability of the reporting.

Step 8: Reporting

Report on both active and inactive sustainability efforts. Provide both qualitative and quantitative details, describing the current state of affairs and the future vision with set goals.

Sharing the report encourages stakeholders to provide feedback. By carefully considering this feedback, you can improve your ESG performance, resulting in a clearer and more effective report for the coming year.

Publish the report on your website, send it via email to customers and investors, share it on social media, and discuss it personally. Emphasizing your sustainability efforts can give you a competitive edge in a competitive market.

Use the reporting cycle as an opportunity for continuous evaluation, learning, and improvement. Annually set clear goals to improve sustainability performance, incorporating active feedback from stakeholders.

Working on your ESG objectives of tomorrow, today?

The People Sustainability scan lists all of your company’s well-being efforts and links them to the 17 SDGs. The result is a clear overview, maybe even linked to advice to optimise, that functions perfectly as a reporting tool for the ESG reporting. In the ESG reporting, well-being falls under the “S” of Social, aside from the two other cornerstones, Environmental & Governance.